Taxes be taxin’

It’s tax season in Taiwan. If you’re lucky, the nightmare has a happy ending…

Every May in Taiwan, you pay income tax for the preceding calendar year.

I wasn’t here in 2022, so in 2023 I avoided tax season.

But I was here last year, so in 2024 I haven’t been so lucky.

After being away from New Zealand for six months, my tax residency changed to Taiwan. For most people this wouldn’t be an issue, as their Taiwanese employer would deduct income tax on their behalf.

But for me, living off savings while starting a new business, I don’t have an employer to step me through the process.

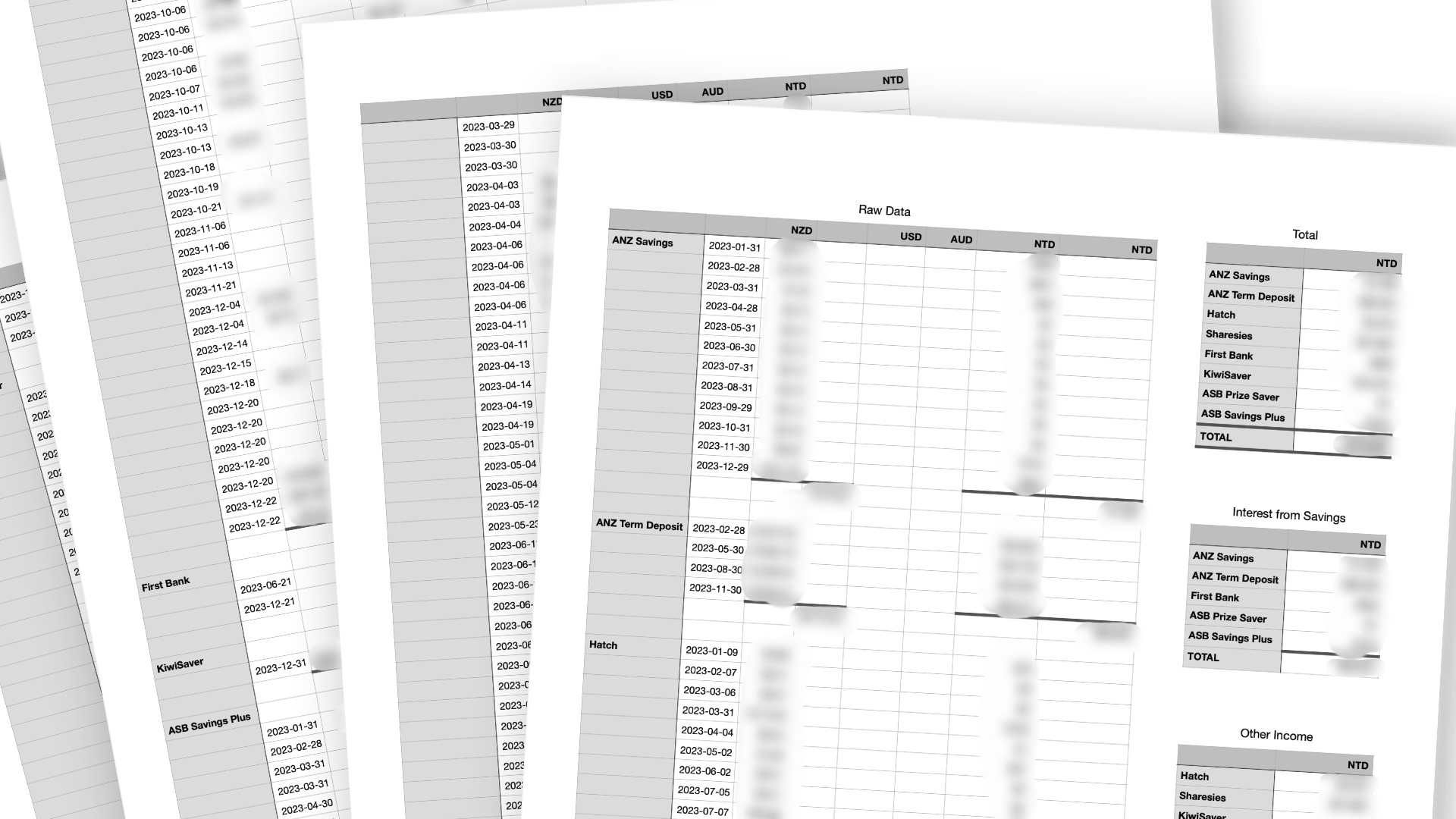

And because my income primarily comes from (small-time) investments outside of Taiwan, I need to convert every cent of income to New Taiwan Dollars (NT$) on the day that income was received. So I had to go through a year’s worth of financial data, applying the historical exchange rate to every transaction.

Unfortunately, because I’m a nonsensical investor, there are some companies for which I hold a just one share. So I found myself making historical currency conversions for dividends as low as US$0.11.

The same goes for near-dormant accounts, such as my ASB Bank ‘Prize Saver’, which I opened in a fit of randomness 10 or 20 years ago. It generated 50 cents of interest over the entirety of 2023.

(In my case, ‘Prize’ and ‘Saver’ are both misnomers.)

After two full days of collating, converting, and calculating, I was ready to jump into the online tax portal.

A couple of months prior, a friend helped me prepare for this moment by purchasing an ID card reader. It connects to my Mac and uses my National Health Insurance card to verify my identity:

I’d never encountered at-home ID card readers before. They cost around NT$200 (NZ$10).

The English-language e-filing portal was confusing when it came to choosing the correct income types. I can see why foreigners with greater incomes might hire an accountant.

It took a painful couple of hours to verify my identity and complete my return. Choosing from the correct income categories (translated from jargonistic Chinese to jargonistic English) felt like a game of chance.

Then, as I was nearing the end of this bewildering process, I was told to bring authenticated documents to the tax office.

This was problematic for a few reasons:

- The Taiwan tax year is January–December, but the New Zealand tax year is April–March. So my documents don’t align.

- In most cases, I don’t have physical documents anyway.

- Even if I had documentation, Taiwan requires it to be authenticated by Inland Revenue in New Zealand. But I’m not in New Zealand.

I screenshotted and printed everything I could think of, and rode my scooter to the National Taxation Bureau of Kaohsiung.

There was a separate side-entrance for foreigners. It led to a lobby with four or five staff at temporary workstations along one wall. As two other employees and the security guard looked on with curiosity, my appointed agent deleted row after row of data from my tax return.

I’d spent two grueling days collating, converting, and calculating those figures. So I felt a mix of relief and despair as they vanished in front of me: relief that any mistakes were now inconsequential, and despair at the many hours of spreadsheeting I’d never get back.

My overseas income was below the taxation threshold, so didn’t need to be declared. The agent said I only needed to pay tax on the negligible amount of interest earned by my Taiwanese bank account.

Meaning that, after deductibles, I got a refund of NT$7 (NZ$0.35).

To celebrate this windfall, I went to FamilyMart and blew it all on candy: